Going Beyond

M&A and Activism Compendium

Thank you for visiting our M&A and Activism Compendium. The content you clicked on is directly below along with other articles, Case Studies and recent transactions. Our goal is to help executives, investors and financial service professionals navigate the ever-shifting world of M&A and activism.

We strive to provide relevant content on how to win, with a view from our angle, down in the trenches with the shareholders.

Wherever you look, shareholder activism is on the rise. As a recent uncovered, 2023 saw shareholder activism reach a four-year global high, with almost 1,000 companies subjected to activist demands publicly. With this trend seeming set to continue – nearly a quarter of companies disclosed the potential for activism in their 10-K reporting – executives must understand the precise threats they’re likely to encounter.

The activist had acquired a substantial stake in the company and was demanding the company triple the dividend payout and elect 2 new directors. To complicate matters, more than 45% of the company’s outstanding shares was in the hands of foreign shareholders. It was projected that the activist could win because these shares were likely to vote against management and with the activist.

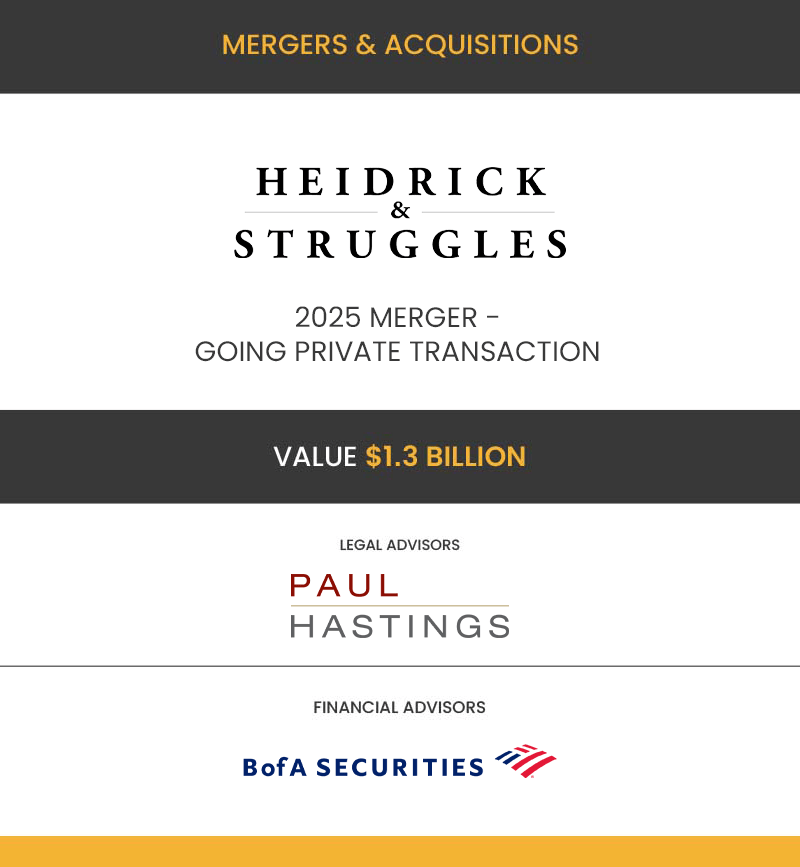

Representative M&A Transactions

Representative Activism Transactions

Our Activism Experts

Activism & Governance Overview

With 韩国GV Advisors Going Beyond research series, we bring to the forefront pivotal discussions and content that are shaping the world of Corporate Governance, Executive Compensation, ESG, Shareholder Activism, Retail Outreach and M&A.